The Racialization of Student Debt

To quote MA state representative Ayanna Pressely, “You can’t be anti-racist if you’re anti student debt cancellation.”

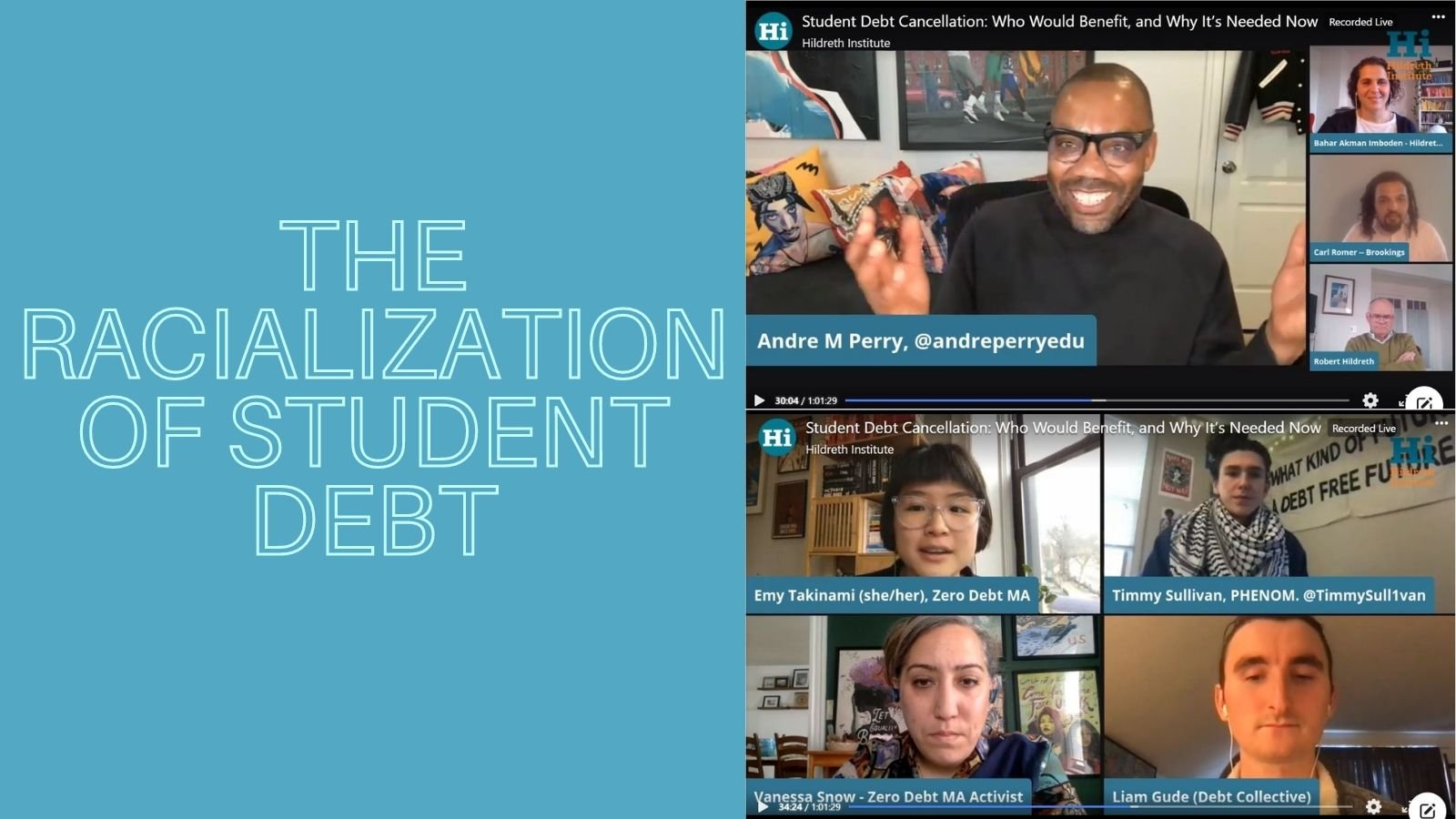

Student debt has the unique distinction of being a product of the racial wealth gap, and a factor that contributes to this disparity. In the midst of increasing demands for student debt cancellation, we invited experts from Brookings Institution to discuss how student debt has become a racial justice issue and who would benefit actually from debt cancellation. We also invited activists and borrowers from ZeroDebt MA, PHENOM, the MA Debt Collective, and SEIU 509 Local to share their experiences and perspectives on the issue (see full recording below).

Student debt is disproportionally held by people of color and low-income families. Studies indicate that by graduation, the typical black graduate owes 50% more than their white counterpart. In addition, up to 7% of the racial wealth gap in 2016 was directly attributed to student debt and this figure is expected to grow.The case for student debt cancellation is economically, racially, and morally clear. Our guest, Andre M. Perry, Senior Policy Fellow at Brookings Metropolitan Policy Program warned us that wealth extraction from student debt is “robbing people of the opportunity to climb the economic and social ladders.”

He explained that student debt cancellation will provide wealth-poor individuals the opportunity to build wealth, seek opportunities for economic development, and significantly reduce the racial wealth gap. Contradictory to mainstream media claims, his research demonstrates that debt cancellation is not a policy that will disproportionately benefit wealthy white individuals.This is because most of the student debt is held by low-income and low-wealth individuals, and they are disproportionately harmed by the burden of student loan payments.

Our guest Carl Romer’s research shows that 51% of student debt is held by households with zero or negative net worth. To compound this issue, other studies have shown that 90% of student loan borrowers in default are Pell Grant recipients whose income and wealth was low prior to college enrollment. Debt cancellation will provide immediate economic relief to low-income individuals in need and reduce the racial wealth gap.

There are few debt cancellation proposals that range from $10,000 to $50,000 to universal cancellation of all student loans. However, since student debt disproportionately lies along the lines of race and wealth, any cancellation should consider how student debt has served as a racialized transfer of wealth. Although full cancellation of all debt is most preferable, anything less than $50,000 would not have the ameliorative racial wealth effects that larger cancellation policies would have.

For some students like Zero Debt MA Activist Venessa Snow, even $50,000 in debt cancellation would not have any effect for years. After graduating from UMASS Amherst during the 2009 Great Recession, Venessa was unable to make any payments during her first year out of college. One year of missed payments took her 7 years to correct, and her current $76,000 student debt balance now equates to about “a $10,000 pay cut each year.”

So how can you support student debt cancellation initiatives? In Massachusetts, there are many ways to get involved. You can join a student debt advocacy group such as ZeroDebt MA, PHENOM, and the MA Debt Collective.

You can urge your politician to support legislation, such as Bill H. 1339 and Bill H. 2931, that will guarantee debt free public higher education for all. Regardless of how you choose to become involved, remaining silent on this issue perpetuates the systems of racial wealth inequality.