Mapping Student Debt Burden in Massachusetts

By Bahar Akman Imboden

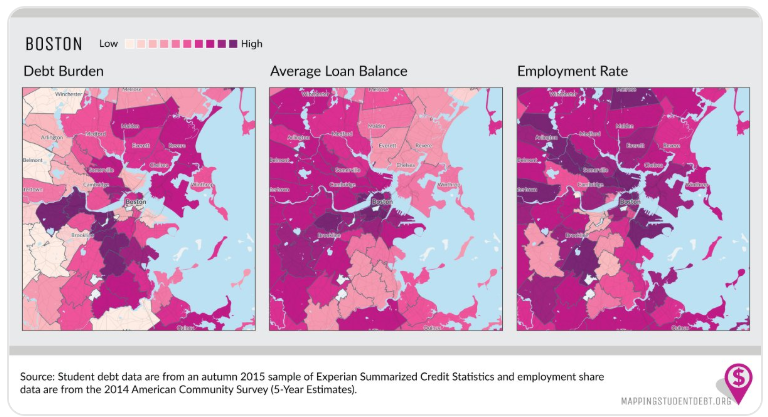

Generation Progress and HigherEdNotDebt launched their third iterations of their Mapping Student Debt series. They unveiled new maps showing the average student debt burden, defined as the share of income spent on student loan payments, across ZIP codes. At the national level, these maps show that student debt burdens people across income groups and geographic regions. Looking specifically at the Boston area, we observe that debt is burdening much of Boston metropolitan area (see map below). A closer look at the maps reveals different college debt stories, from which we can draw some important lessons.

First, we would expect that areas with lower student debt balances and high employment rates should have lower debt burden. But this is not the case for many areas around Boston. East Boston, Chelsea, Everett, Revere, or Malden, but also Allston and Brighton have high debt burdens. This suggests that the degrees obtained by those residing in these zips codes have not resulted in high-paying jobs. This indicates that college degrees financed by debt, even if it is low amounts, are not lifting these populations up. Alternatively, it might suggest that there are high percentages college dropouts; that is, people who have lower-paying jobs but who still have to repay loans they borrowed attempting to get a college education. This highlights how risky student loans can be for those seeking increased economic mobility via higher education.

However, student debt seems to also burden those whose degrees have led to high-paying jobs. In Somerville and Cambridge, we see high employment rates, higher income rates, but still very high debt burden, mostly due to high debt balances. It is clear that student debt weighs heavy on our youth, even when their college degrees led to good employment.

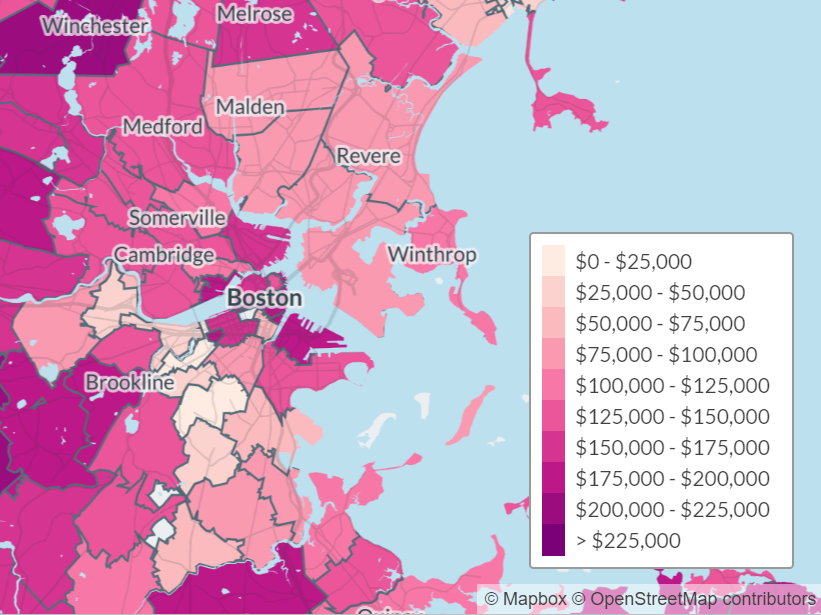

Finally, it is striking to see the high degree of debt burden around Fenway, Roxbury, and Dorchester. In this case, we see a combination of high average debt (as high as $50,914), low employment rate (49%), and median income as low as $27,000, resulting in residents paying more than 10% of their income towards debt. This is a big red flag for our state, that students borrow such large amount of debt for degrees that led to such low-paying jobs.

Boston Median income:

It is clear that we are dealing with a systemic problem here. Student debt burden is a societal problem, which needs to be addressed swiftly so that the long-term economic impact of debt can be mitigated.